Stress Testing Bitcoin Miners: Can CORZ, WULF, and CIFR Survive a Crypto Winter at $50K-$70K BTC?

The crypto market is in turmoil. As of November 22, 2025, Bitcoin (BTC) has plunged from its 2025 peak of ~$120K to around $82K,a 33% drop that’s wiped out all gains for the year.

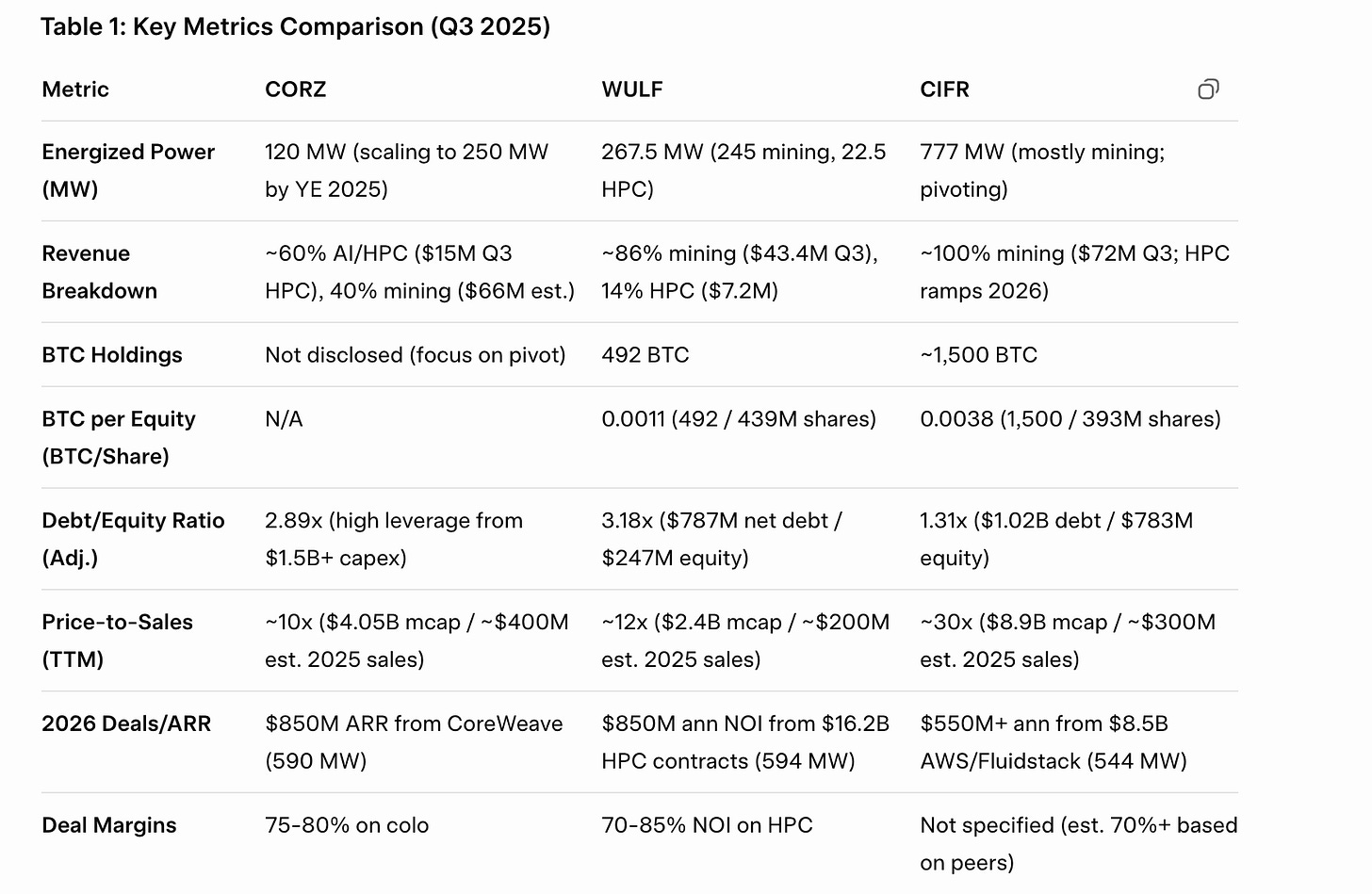

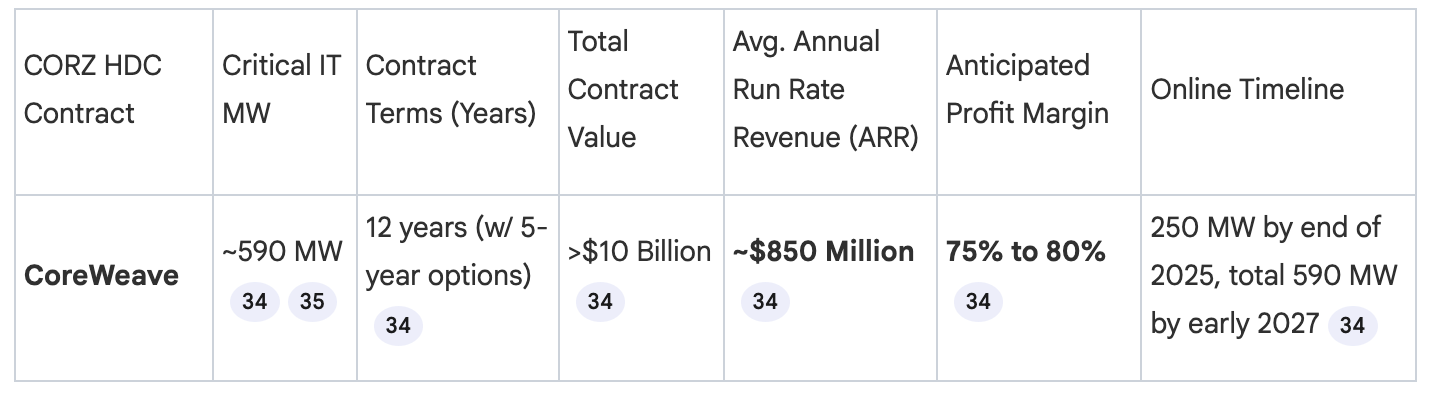

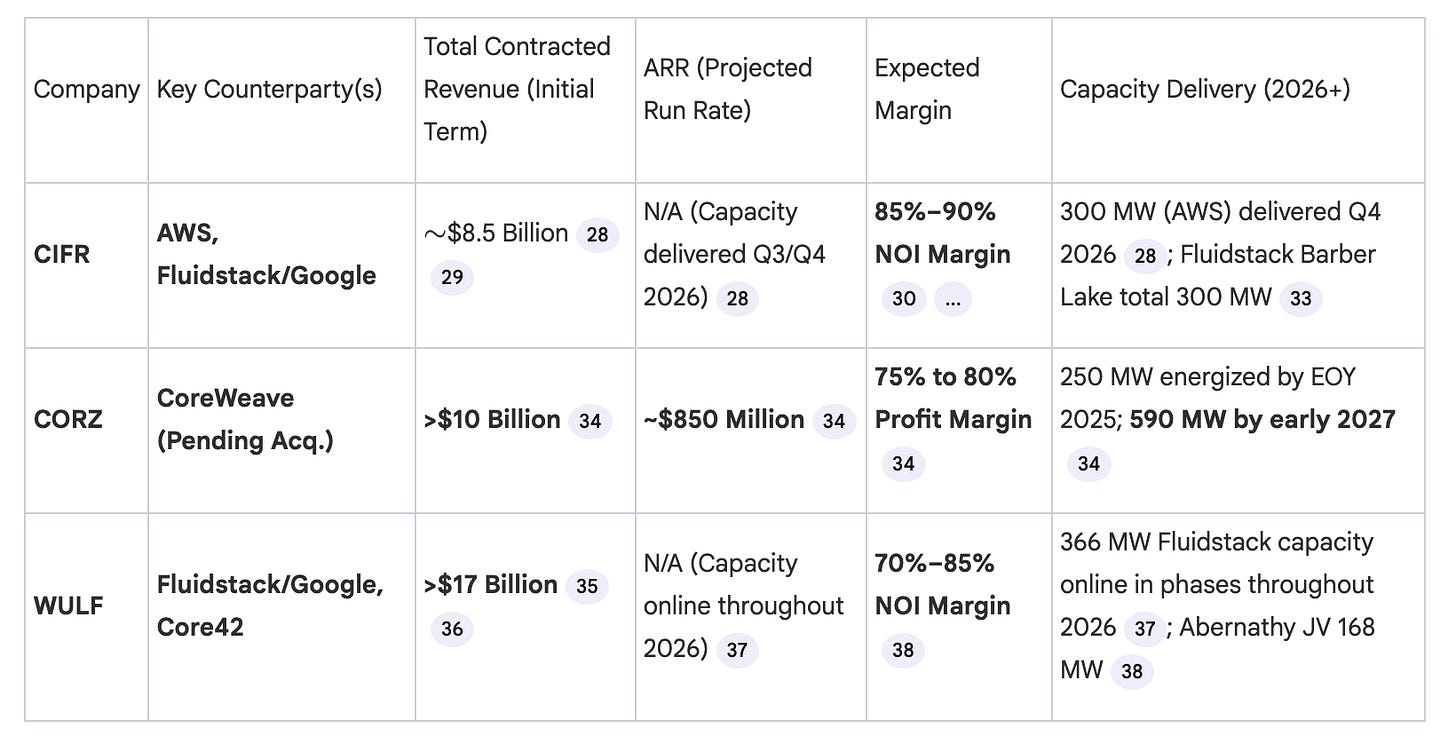

For this article focus will be on Core Scientific (CORZ), TeraWulf (WULF), and Cipher Mining (CIFR). These firms still derive the bulk of their revenues from BTC mining (60-80% based on Q3 2025 filings), where profitability hinges on hash rates, power costs, and coin prices. These colocation agreements often feature high anticipated Net Operating Income (NOI) margins (85%-90% for CIFR/WULF’s HPC contracts; 75% to 80% for CORZ’s CoreWeave contract), because the operating model is structured so that the tenant (the HPC customer) often pays for the power, thus insulating the infrastructure provider from energy commodity price volatility.

Exclusion of GPU Neoclouds:

We are not analyzing GPU neoclouds (like CoreWeave, Nebius or IREN) due to my investment focus. These colocation companies are essentially the real estate and power landlords to those cloud platforms, securing long-term lease payments which constitute the highly stable ARR you are analyzing

But all three are pivoting to AI/HPC colocation, leasing energized power to hyperscalers for stable, high-margin revenue. Using their latest investor presentations, Q3 2025 10-Q filings, news reports, and X sentiment (where posts highlight mining pain but pivot optimism), I’ll stress test their resilience. We’ll examine BTC per equity (exposure to coin volatility), debt/equity (leverage risk), price-to-sales (valuation stretch), 2026 deals/ARR (pivot buffer), and deal margins. Scenarios model cash flow at BTC $82K (current), $70K, and $50K, assuming constant hash rates and costs from filings.

Metaphor: The transition mirrors an airline company moving away from relying on fluctuating passenger ticket sales (Bitcoin price) to signing decade-long, fixed-fee contracts to lease its entire fleet and highly specialized hangars to a stable logistics giant (hyperscalers). Although the turbulence of ticket sales still exists, the majority of future revenue and profitability are now secured by contractual, predictable infrastructure payments.

Quick Company Snapshots

CORZ: Heavy AI pivot (500 MW contracted to CoreWeave), but mining still ~40% revenue. High debt from conversions risks amplification in downturns.

WULF: Balanced hybrid (245 MW mining, 22.5 MW HPC now; 594 MW HPC contracted). Low power costs ($0.047/kWh) provide buffer.

CIFR: Aggressive HPC shift (67% MW to AI; $8.5B deals with AWS/Fluidstack). Strong cash position post-raises.

Bitcoin Crash vs. AI Stability

The analysis focuses on the impact of Bitcoin falling from a hypothetical 120,000 level to 80k, and the catastrophic scenario of $70,000 to $50,000. For both companies, the pivot to HPC/AI infrastructure leasing is the primary defense against volatile BTC prices.

Part 1: Operational Stress Test (BTC Mining Profitability)

A direct BTC price collapse severely pressures the traditional self-mining segment of both companies.

A. TeraWulf (WULF) Mining Resilience

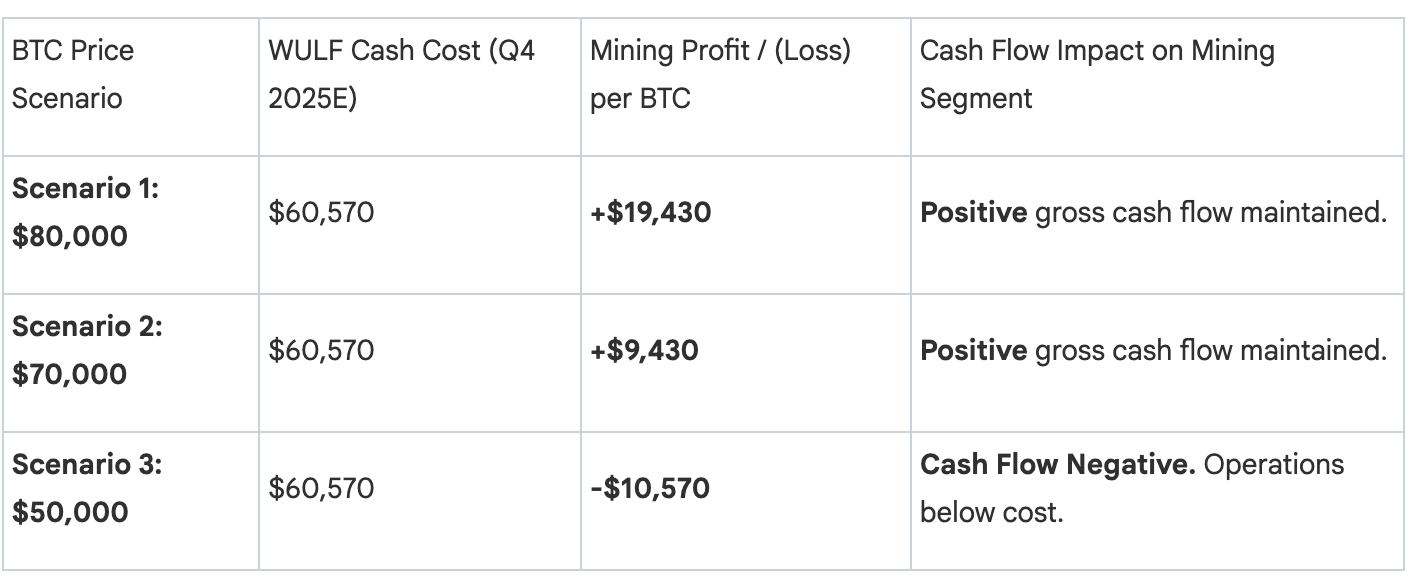

TeraWulf operates its own Bitcoin mining segment, which demonstrates a clear cash cost floor, based on their projections for Q4 2025. WULF’s power cost achieved $0.047/kWh in Q3 2025.

WULF Cash Cost to Mine 1 BTC (Q4 2025E) The total cash cost to mine one Bitcoin is projected to be $60,570 in Q4 2025. This estimate includes power costs of $51,765 per BTC and operating expenses of $8,805 per BTC

WULF Operational Conclusion: TeraWulf’s mining operations remain cash-flow positive even at Bitcoin prices down to the low $60,000s. A fall into the $50,000 range would push the segment into negative cash profitability. This risk is fundamentally mitigated by the company’s ability to redeploy existing mining capacity to HPC. WULF maintains approximately 130 MW in current BTC mining operation, but has 594 MW contracted for HPC colocation.

WULF 2026 Cash Flow Enhancement: The expected annual run rate NOI of nearly $1 Billion from these contracted deals, which are scheduled to come online in phases throughout 2026, represents revenue that is independent of BTC price volatility and secured by long terms and credit enhancements from Google/G42.

B. Core Scientific (CORZ) Mining Vulnerability

Core Scientific currently derives the majority of its revenue from digital asset self-mining, though it plans to rapidly increase revenue from HDC.

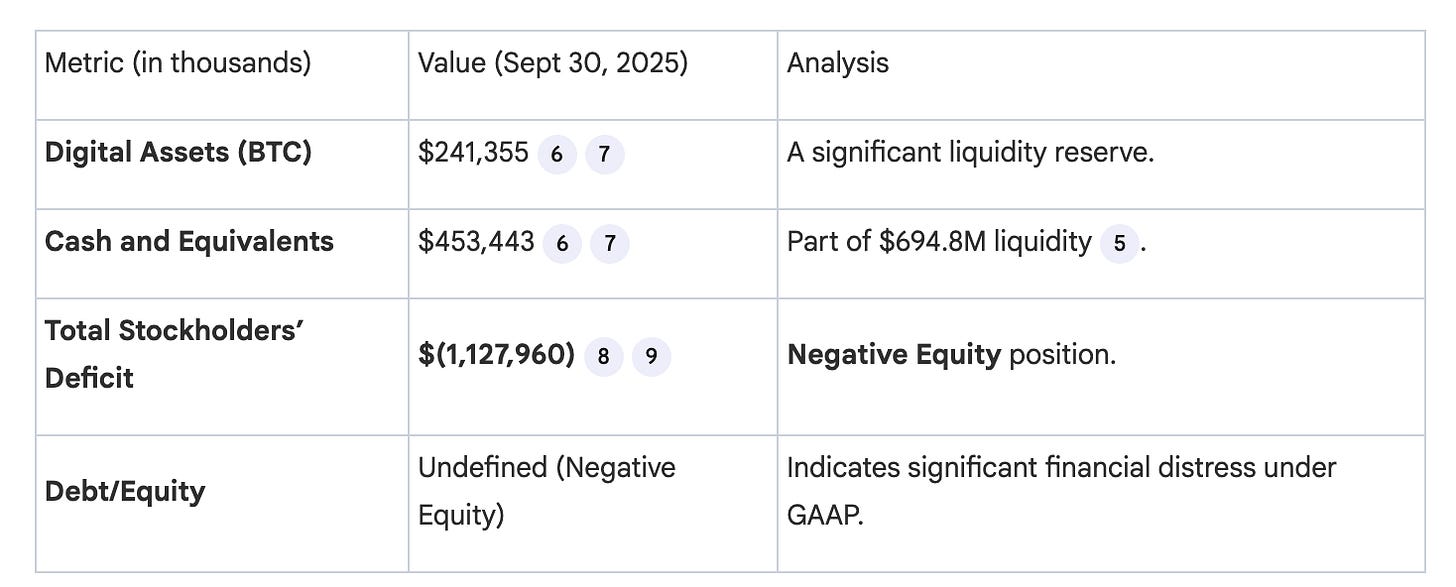

CORZ Mining Profitability (Q3 2025 Actual) In Q3 2025, Core Scientific’s Digital Asset Self-Mining segment reported a gross loss of $(2.0) million, resulting in a negative gross margin of (3)%. This segment generated $57.4 million in revenue versus $59.4 million in cost of revenue.

CORZ Operational Conclusion: Core Scientific’s Bitcoin mining segment was already operating at a gross loss in Q3 2025, even with the benefit of an 88% increase in the average Bitcoin price compared to Q3 2024. A hypothetical crash of BTC from $120,000 down to the 80,000–50,000 range would severely accelerate cash burn in the mining segment. The company’s financial stability is therefore entirely dependent on its transition to high-density colocation.

Part 2: Financial Resilience Metrics

A. Core Scientific (CORZ) Financial Health (Q3 2025)

BTC per Equity (CORZ): Since Core Scientific operates with a Total Stockholders’ Deficit of approximately **1.13 billion∗∗ as of September30,2025, its Bitcoin holdings (241.4 million) represent a key part of its total assets, but the equity foundation is severely distressed.

Price to Sales (P/S) Analysis (CORZ): Total revenue for Q3 2025 was $81.1 million. The company derives the majority of its current revenue from earning digital assets for its own account. Given the pending acquisition by CoreWeave, calculating P/S is secondary to evaluating the fixed-revenue contracts.

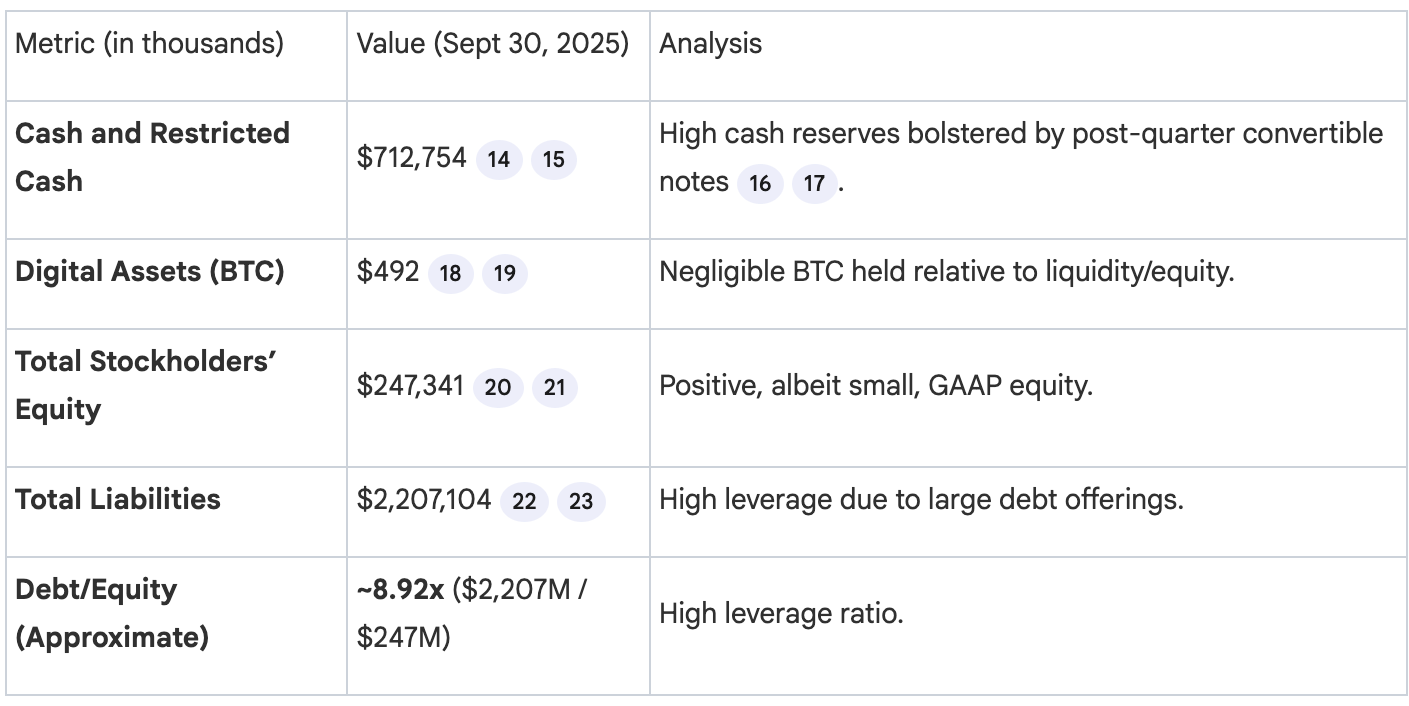

B. TeraWulf (WULF) Financial Health (Q3 2025)

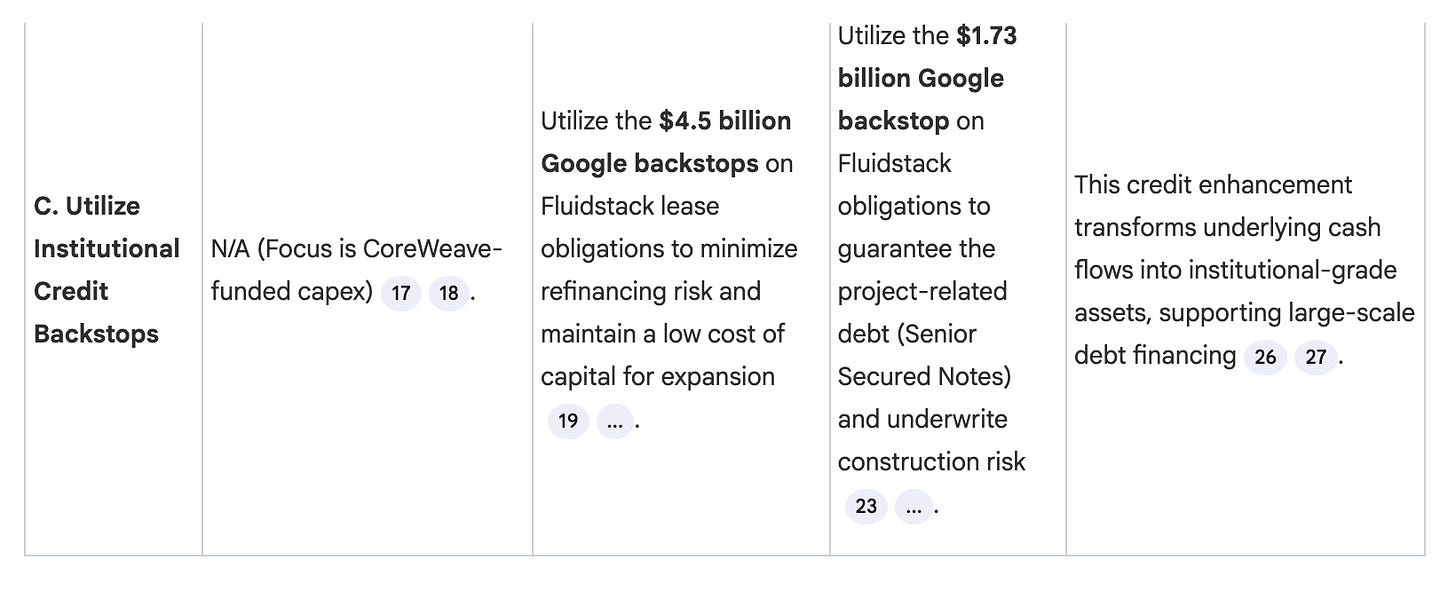

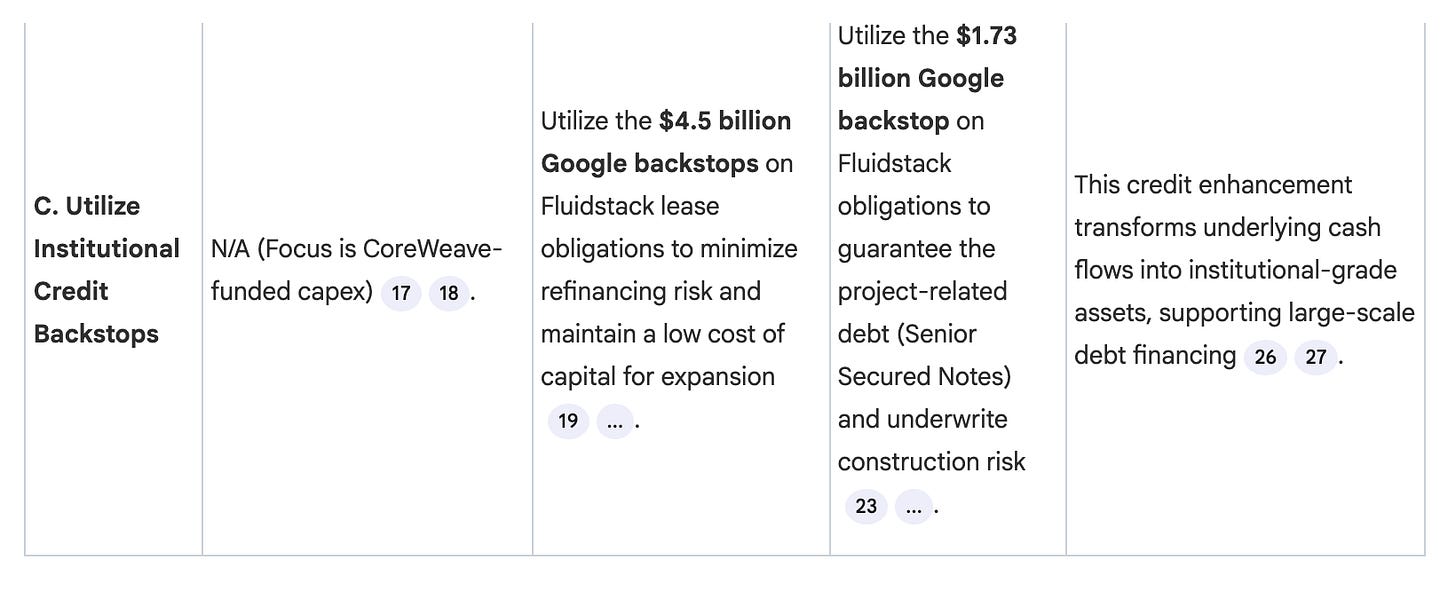

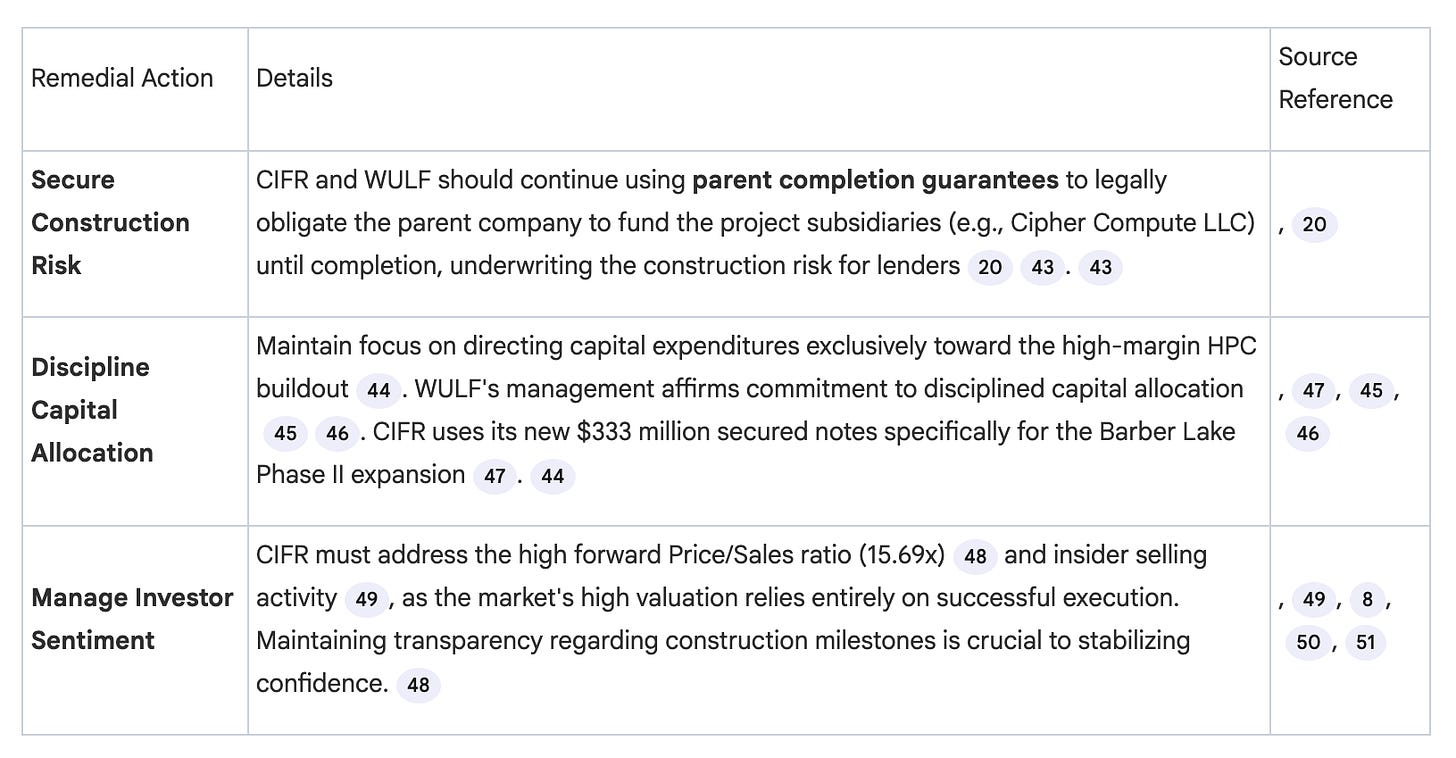

Debt Risk Mitigation (WULF): While the Debt/Equity ratio is high, the risk associated with its 3.2 billion offering of 7.750. This debt, used to finance 522.5MW of AI/HPC DataCenters, is secured by a 3.2B Google lease backstop, which fully covers the debt exposure and mitigates construction and counterparty risk. This structure positions WULF favorably within the institutional credit market.

B. Core Scientific (CORZ) HDC Contracts & 2026 ARR

Core Scientific’s HDC contracts are specifically designed to replace volatile mining revenue with durable, high-margin, fixed-fee arrangement.

CORZ 2026 Cash Flow Enhancement: The CoreWeave contracts alone are set to generate approximately $850 million in average annual run rate revenue. These agreements feature fixed pricing with annual escalators and are defined as take-or-pay contracts, meaning the customer (CoreWeave) is committed to paying for the capacity regardless of utilization. This fixed, high-margin revenue stream provides maximum cash flow stability, directly offsetting the vulnerability in the legacy self-mining segment.

Stress Test: BTC Price Collapse and the $30+ Billion AI Infrastructure Pivot (CORZ, WULF, & CIFR)

Bitcoin infrastructure companies Core Scientific (CORZ), TeraWulf (WULF), and Cipher Mining (CIFR) are undergoing a fundamental transformation from volatile cryptocurrency producers to contracted providers of high-margin AI/High-Performance Computing (HPC) infrastructure.

This analysis stress tests their current mining operations against a significant Bitcoin (BTC) price collapse (from the Q3 2025 implied baseline of ∼$115k down to $80k and $50k) and evaluates whether their long-term HPC strategies provide a sufficient financial firewall against this volatility.

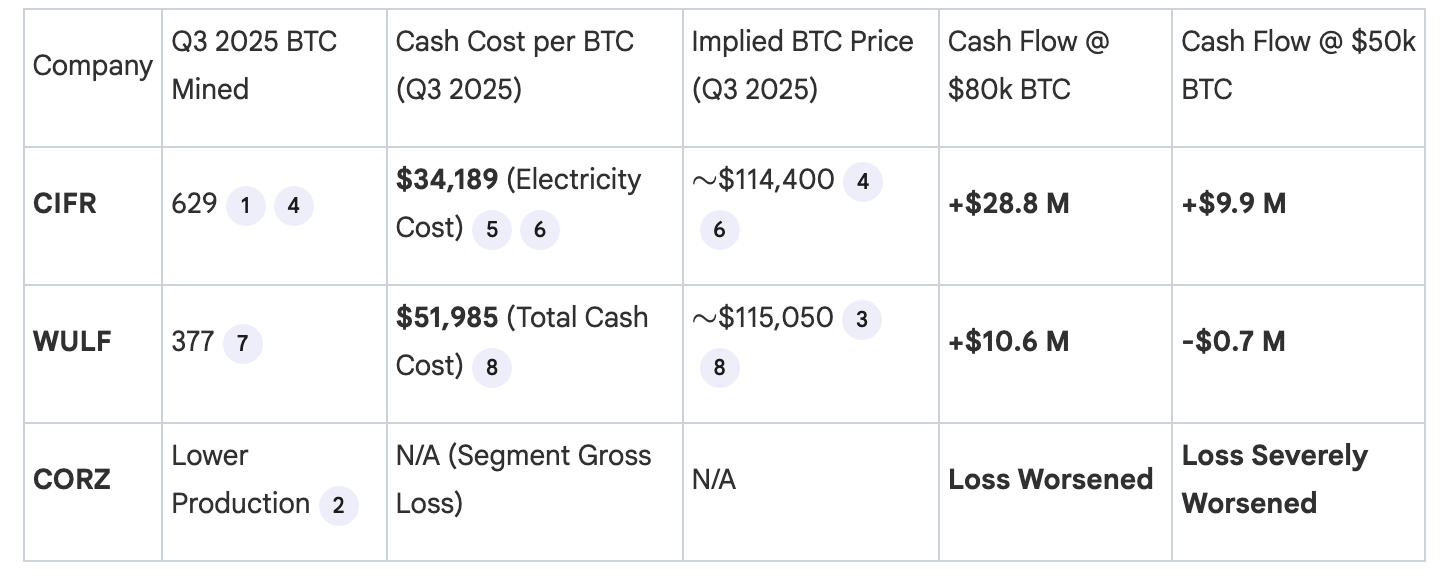

Part I: Bitcoin Mining Cash Flow Stress Test (Q3 2025 Baseline)

All three companies derived significant revenue from digital asset mining in Q3 2025. However, the efficiency and scale of these operations dictate their vulnerability to a BTC price decline.

The stress test assumes Q3 2025 production rates and fixed cash costs (primarily power and operating expenses) remain constant.

Table 1: Quarterly Mining Cash Flow Under Stressed BTC Prices (in Millions USD)

Stress Test Findings on Operations:

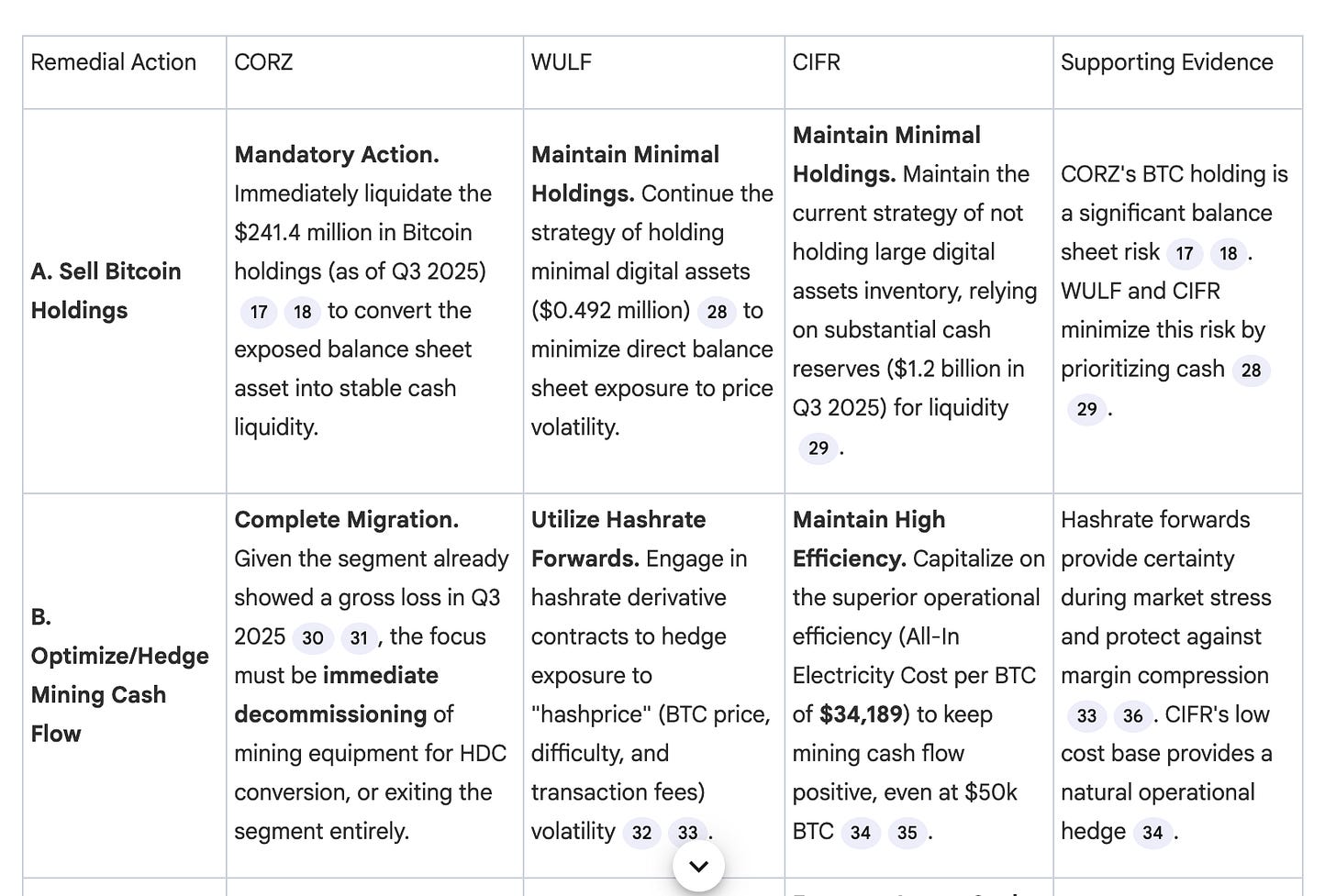

1. Cipher Mining (CIFR): Strongest Operational Resilience. Due to an efficient fleet (16.8 J/TH) and a low All-In Electricity Cost per BTC of $34,189, CIFR maintains a positive cash flow of nearly $10 million per quarter even if BTC drops to $50,000. CIFR’s efficiency allows it to weather the price crash better than its peers on an operating basis.

2. TeraWulf (WULF): Breakeven Resilience. WULF’s operations were highly profitable at the $115k baseline. However, a drop to $50,000 would make the mining segment marginally cash flow negative (by about $0.7 million per quarter), confirming a cash breakeven point near $52,000 per BTC.

3. Core Scientific (CORZ): Immediate Vulnerability. The company’s digital asset self-mining segment already reported a gross loss of ($2.0) million in Q3 2025, despite an 88% increase in average Bitcoin price compared to the prior year. A fall to $80k or $50k BTC would severely exacerbate this negative cash flow, putting immediate stress on the company’s non-HPC operations.

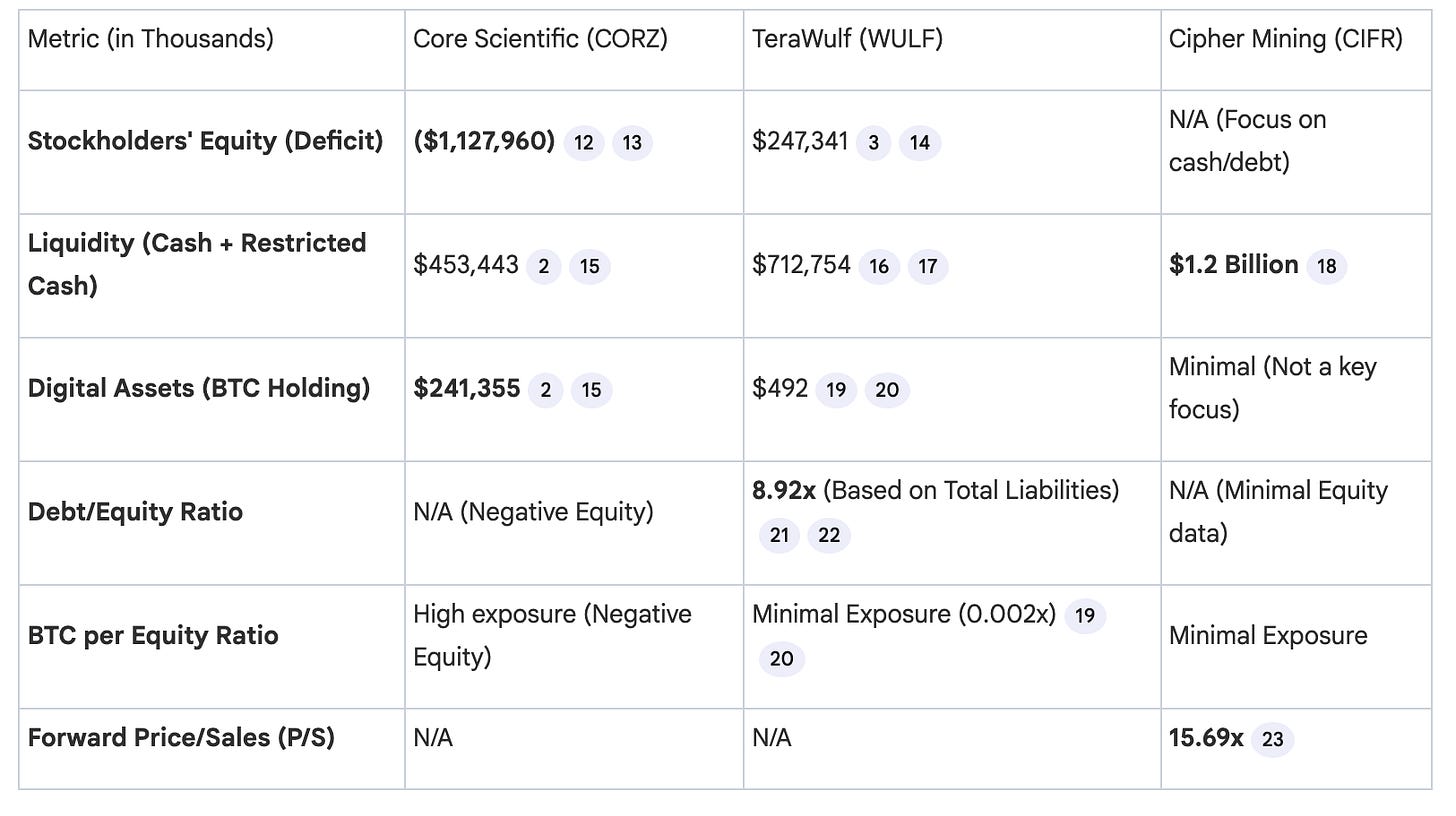

Part II: Financial Health, Leverage, and BTC Exposure

We compare the balance sheet status (Q3 2025) to evaluate the companies’ ability to fund their HPC expansion during a market downturn.

Table 2: Financial Ratios and Liquidity Exposure (as of September 30, 2025)

Balance Sheet and BTC Risk:

• CORZ: The company has the highest exposure to a BTC price drop because it held $241.4 million in digital assets. A drop to $50k would directly impair this liquidity, worsening its pre-existing Stockholders’ Deficit.

• WULF and CIFR: Both companies hold minimal digital assets on their balance sheets, insulating them from direct Bitcoin impairment risk.

• Liquidity and Debt: CIFR reported strong liquidity with $1.2 billion in cash and cash equivalents, providing a substantial cushion for construction financing. CIFR is financing its expansion via senior secured notes (7.125% due 2030).

• Price-to-Sales (P/S) & Risk: CIFR’s forward P/S ratio of 15.69x is significantly higher than the industry average (2.54x). This premium indicates that investors are already pricing in the successful execution of its multi-billion dollar HPC contracts. Consequently, CIFR faces high execution risk; any delays or cost overruns in delivering the contracted capacity could disproportionately harm its valuation.

• Insider Sentiment (CIFR): Insider activity over the last six months shows 70 sales and 0 purchases, with large block selling by major holders like V3 HOLDING LTD (selling 32,061,598 shares for ∼$384 million). This sustained selling pressure from insiders could reflect a realization of gains or cautious sentiment, despite positive operational news.

Part III: The AI Firewall: Deals, ARR (2026+), and Margins

The core strategy mitigating the BTC price collapse risk is the transition to high-margin HPC infrastructure, securing long-term revenues largely independent of cryptocurrency prices.

Table 3: Summary of HPC Contracted Capacity, Revenue, and Margins

Analysis of 2026+ ARR and Margins:

1. Revenue Profile Shift: The collective contracted HPC revenue pipeline across these three companies exceeds $30 billion, fundamentally altering their long-term financial structure. The annualized run rate revenue (ARR) from these deals starting in 2026/2027 will far surpass their current digital asset mining revenues (e.g., CORZ’s projected $850 million ARR vs. Q3 2025 total revenue of $81.1 million).

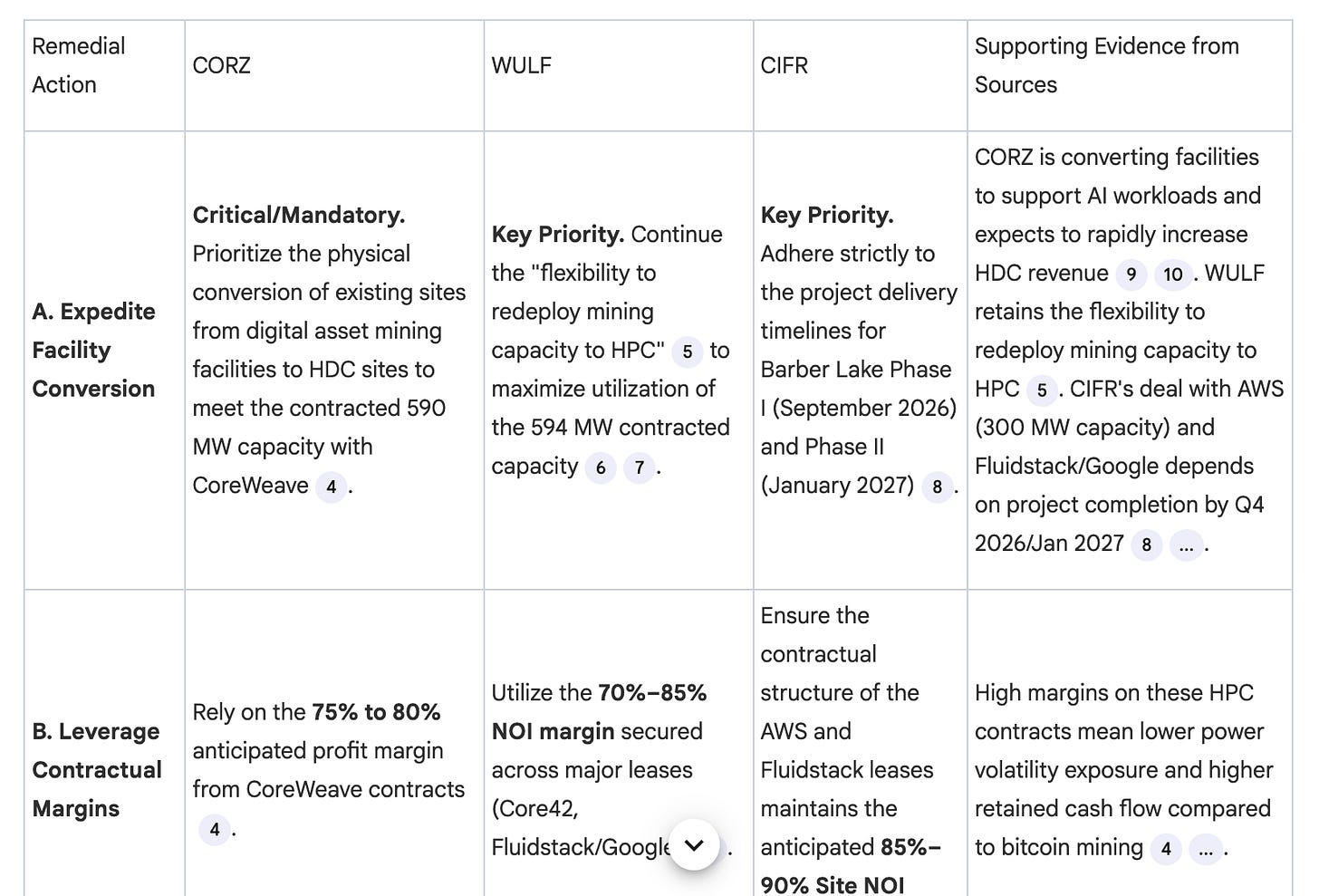

2. High Margins: The high projected margins, 85%–90% NOI for CIFR, and 75%–85% NOI/Profit for WULF and CORZ - are achievable because these contracts are typically structured as modified gross leases, where the tenants (hyperscalers like AWS and Google/Fluidstack) bear the majority of variable operating costs, including power price volatility. This structure transforms the business risk from unpredictable commodity prices to stable, contractual real estate leasing.

3. Credit Quality: The financial durability is bolstered by the involvement of investment-grade counterparties. CIFR’s Fluidstack contracts are supported by a $1.73 billion Google backstop, and WULF’s contracts benefit from Google backstops totaling ∼$4.5 billion. This credit enhancement de-risks the debt financing used for construction.

4. CIFR’s Execution Strategy: Cipher is actively financing its capacity expansion with debt (333.0millionof7.125, specifically targeting construction at its BarberLake facility to meet there required capacity delivery by early 2027. The high estimated project cost of **$9–$10 million per MW** of critical IT load underscores the specialized, high-density infrastructure required for AI workloads.

Summary: Navigating the Cash Flow Crisis

The stress test reveals a clear dichotomy: a Bitcoin price collapse to $50k would create an immediate, worsening cash flow situation for the legacy mining segment of all three companies, pushing WULF into marginal negative cash flow and deepening CORZ’s existing gross losses.

However, the severe volatility in the cryptocurrency market is being successfully countered by a pivot to AI/HPC infrastructure. The massive, long-term, and credit-enhanced contracts signed by CIFR ($8.5B backlog), CORZ (>$10B backlog), and WULF (>$17B backlog) provide predictable, high-margin revenue streams that will stabilize and drive cash flow starting in 2026. The shift converts the high-risk cash flows tied to hashprice (BTC price, difficulty, and fees) into resilient, infrastructure-style cash flows backed by Fortune 500 tenants and credit guarantees.

This strategic transformation means that while short-term price movements (BTC falling to $50k) still affect current revenue, the long-term investment thesis is tied entirely to the timely and cost-effective execution of their multi-gigawatt HPC buildouts. Failure to execute on construction timelines (execution risk) now poses a greater threat to their overall financial outlook than BTC price itself

1. Strategy for All Three Companies: Accelerate and De-Risk the HPC Pivot

The most effective long-term remedy against a $50,000 BTC fall is the swift and successful transition to the high-margin High-Performance Computing (HPC) business model, which is already underway and provides a structural firewall against cryptocurrency volatility.

2. Operational and Financial Optimization: Mitigating Short-Term Mining Losses

Given that a $50k BTC price creates immediate cash flow pressure on the mining segment (especially for WULF and CORZ), specific remedies should be implemented:

3. Risk Mitigation: Focus on Execution and Debt Management

The primary risk in this new strategy is Execution Risk the failure to deliver the complex, high-cost HPC facilities on time.

Data sources: Company PDFs (summarized for key metrics), SEC 10-Qs (balance sheets/cash flows), recent news (e.g., CoinDesk on BTC’s 20% monthly drop impacting miners), and X chatter (e.g., threads on CORZ’s debt strain vs. WULF’s HPC wins). All figures as of Q3 2025 unless noted.

Metaphor: For CORZ and WULF, the crash in Bitcoin price serves as an existential risk to their old identity (crypto miner). However, they have rapidly deployed a second identity (AI/HPC Data Center Host). The massive, fixed-rate ARR contracts for HPC act like a seatbelt and airbag system installed just in time to cushion the impact of the cryptocurrency market crash, converting them from volatile energy speculators into highly contracted infrastructure plays.

Verdict: Who Survives the Winter?

CORZ: High risk pivot strong, but debt + mining reliance = cash crunch below $70K. Add if deals expand; fair value $15-25.

WULF: Resilient low costs, $3.7B liquidity; HPC ARR covers. 20-40% upside; buy dips.

CIFR: Winner HPC 67%, $1.2B cash; minimal mining drag. 30-50% upside.

Disclaimer:The information provided in this Substack article is for educational and informational purposes only and does not constitute financial, investment, or professional advice. I am not a licensed financial advisor, and the opinions expressed here are my own and should not be relied upon for making any investment decisions. All investments carry inherent risks, including the potential loss of principal, and past performance is not indicative of future results. Readers are strongly encouraged to conduct their own thorough due diligence, consult with qualified financial professionals, and consider their individual financial situation before making any investment choices. I disclaim any responsibility or liability for any losses or damages that may arise from actions taken based on the content of this article.

The HPC pivot strategy you outlined is realy the key defense for these miners. CIFR's efficiency floor at $50k BTC is impressive compared to the others operting at breakeven or losses. What stands out is how the credit-enhanced contracts from Google and AWS basically tranform these from volatile commodity plays into infrastructure assets. The execution risk you menioned is probably now more important than Bitcoin price itself. Really thorough breakdown of how the business model is fundamentlly changing.

The transition from volatie mining revenue to fixed HPC contracts is really the key differntiator here. What stands out is how these companies are essentially becoming infrastructure landlords rather than commodity speculators. The take-or-pay structure with hyperscalers like Google and AWS transforms the entire risk profile. Even with BTC at $50k, CIFR's efficiency at 16.8 J/TH keeps them cash flow positive, which shows how much operational discipline matters when your building that AI capacity.