RE- RATING BITCOIN MINERS -Why Core Scientific- Coreweave fell through and where does CORZ valuation go from here

With Bitcoin miner AI/HPC pivot well underway and many including Cipher Mining, Terawulf, Iris Energy signing multiyear deals with hyperscalers, its important to ask the Why’s - Why Now? Margins? Energy costs? will they be profitable? . Deals don’t translate to profits unless they own their power or have cheap energy supply with multi year lease agreements, as energy is the biggest cost in this equation. Will keep this discussion to co-location type players and not Nebius, Iris or Coreweave which fall into the category of Neoclouds providing GPUs as a service.

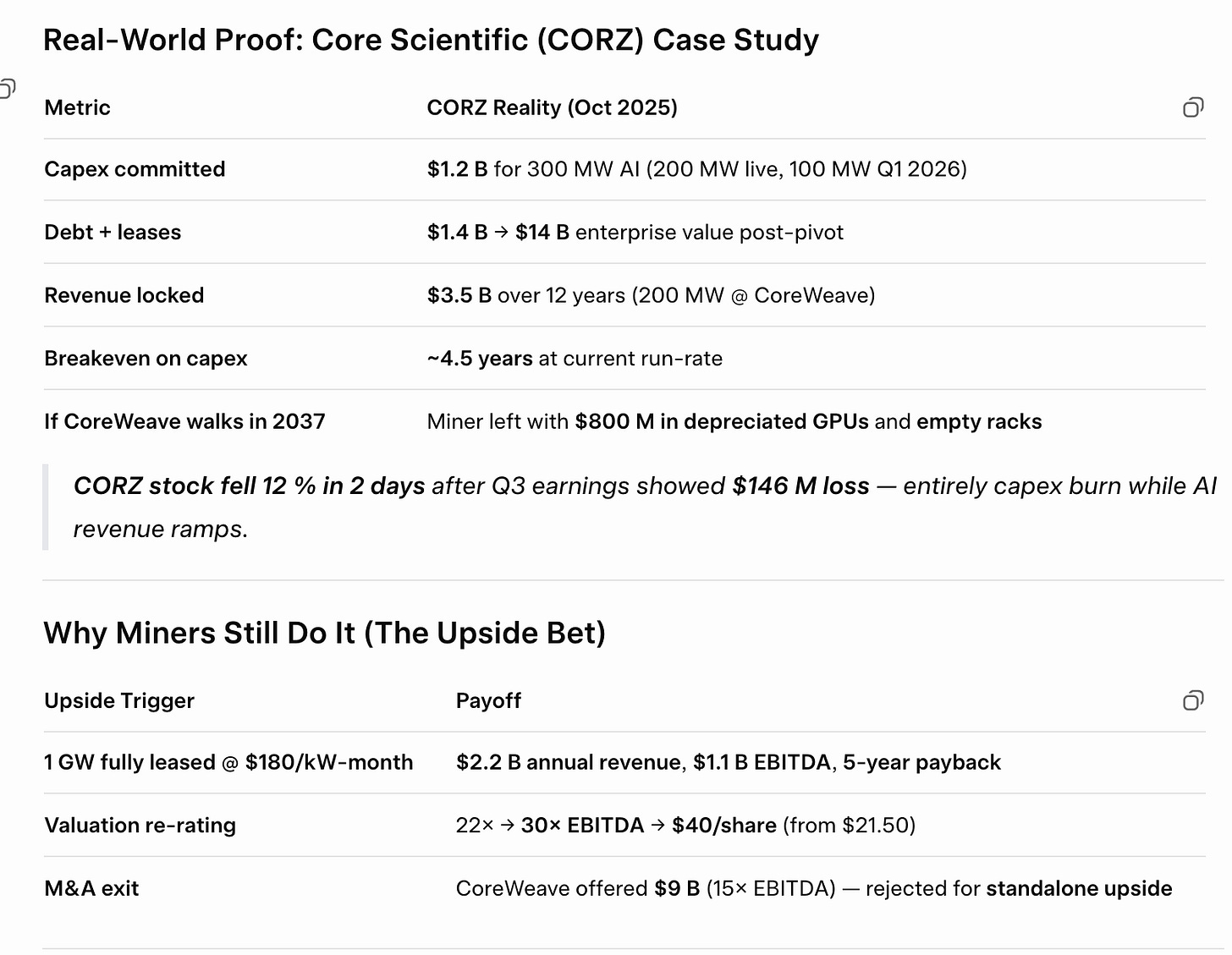

Lets take a look into Core Scientific, Bitcoin miner that restructured from Chapter 11 in early 2024 to ink a deal with Coreweave, the biggest Neocloud in 2025 based on DC revenues. Since Core Scientific, is the only miner which had a contract to sell itself, we can infer economics and viability of running a co-location facility.

The catalyst for this deal was the Core Scientific 1.3GW billable power footprint. CoreWeave, the NVIDIA-backed cloud computing darling valued at over $50 billion post-IPO, was hungry for power, literally. With hyperscalers like Microsoft and OpenAI pounding on its door for GPU clusters, CoreWeave needed ready-made infrastructure fast. Enter Core Scientific, a Bitcoin mining veteran with 590 MW of contracted power (scaling to 1.3 GW+ by 2027) and a pivot toward high-performance computing (HPC).

Then it all fell through. Lets dive in.

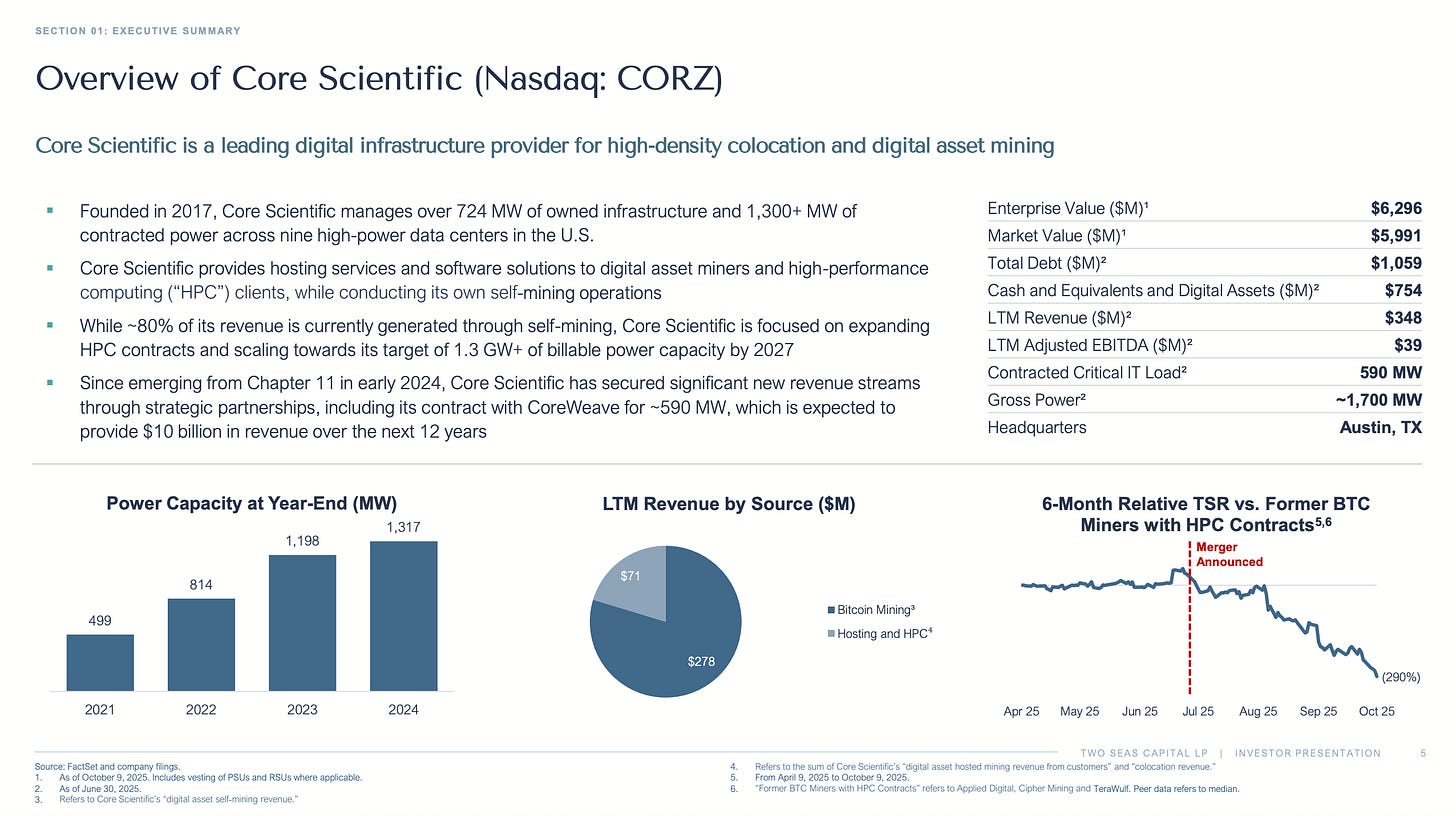

Core Scientific Infrastructure Highlights:( from Two Seas Capital deck)

Why CoreWeave-Core Scientific Deal Crashed and Burned: A Deep Dive into Shareholder Revolt

The deal in June 2025, the all-stock deal valued CORZ at around $9B or $20.40 per share at the time. But by late October, shareholders had decisively voted it down. To unpack this, I dove into a scathing investor presentation from Two Seas Capital LP, a major CORZ stakeholder, filed with the SEC. https://www.sec.gov/Archives/edgar/data/1823138/000090266425004376/p25-2168dfan14a.pdf

Flaw #1: A Rushed, One-Sided Process That Screamed “Insider Favoritism”

Two Seas pulls no punches: The CORZ board ran a “flawed process” that prioritized speed over value. They negotiated exclusively with CoreWeave, skipping any market check or competitive bids despite CORZ’s prime assets, think low-cost power contracts in Texas that take years to secure. A “no-shop” clause locked out other suitors, and the whole thing wrapped in under a month with just one counteroffer, bumping the exchange ratio (0.1235 CoreWeave shares per CORZ share) by a measly 1%.

Worse, the board did a 180 on executive perks. Previously against accelerated equity vesting and tax gross-ups, they greenlit $180 million in incentives, potentially to grease the wheels for a quick close. It’s a classic agency problem, where board decisions favor short-term wins (or personal payouts) over long-term shareholder gains.

Flaw #2: A Structure Built on Sand-Exposed to CoreWeave’s Wild Volatility

The deal’s all-stock, fixed-ratio setup was a ticking time bomb. CoreWeave’s stock is volatile, its coefficient of variation hit 55% since IPO, the highest among Nasdaq peers. Yet there were zero protections: no collar to cap downside, no floating ratio to adjust for swings, nothing. Post-announcement, CoreWeave’s shares tanked ~45% initially, dragging the implied CORZ value from $20.40 to $17.67 per share by October 9. That’s a “take-under”,below CORZ’s pre-rumor closing price (a 44% discount) and even its day-before-announcement level (2% discount).

The arbitrage spread turned negative, with CORZ trading above the deal value, a clear sign investors bet on rejection. Add in CoreWeave’s lock-up expiration (post-Q2 2025 earnings, triggering a 33% drop) and high short interest (36% of float), and you have a recipe for erosion.

Flaw #3: The Price Was Laughably Low

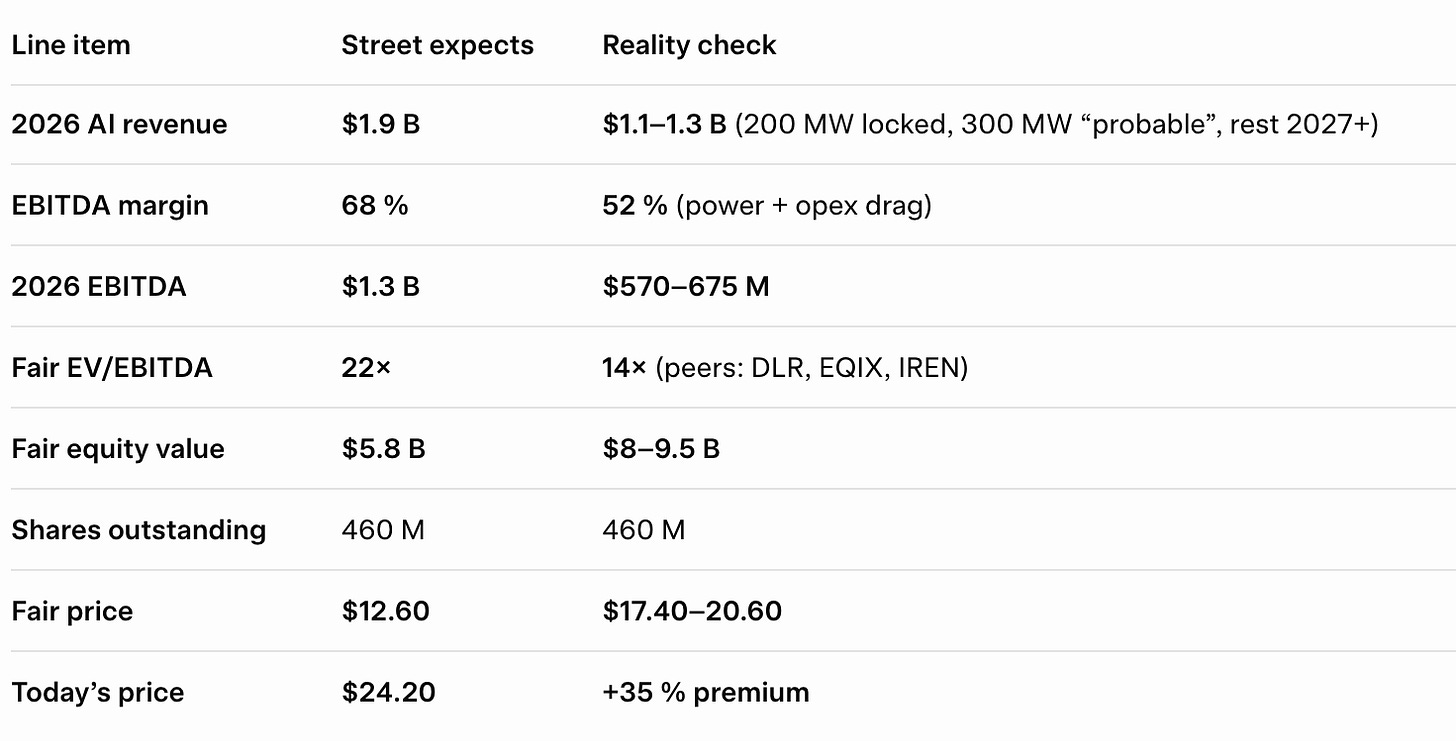

Headline Undervaluation: The $20.40/share offer ignored CORZ’s strategic mojo. With 80% of revenue shifting from volatile Bitcoin mining to stable HPC hosting, CORZ is basically a data center REIT in disguise. Yet the fairness opinion from advisors used “overly conservative” projections, lower revenue/EBITDA growth than consensus, and jacked-up discount rates (8.5%-13% for colocation vs. Two Seas’ 8.3%, matching CoreWeave’s debt yield). Result? A ~35% haircut on value.

Peer Comps Tell the Tale: For data center REITs like Digital Realty (DLR) and Equinix (EQIX), medians hit 19x EV/2027E EBITDA implying $25.64-$33.34 per CORZ

Precedent deals (e.g., Switch Inc. at 22.9x) average 21.3x, 60% above the merger’s 12.6x. For ex-miners like Applied Digital and Cipher, it’s $8.2-$9.3/MW,translating to $30.29-$43.93/share for CORZ’s power pipeline.

1.3GW * $8.2/MW10.6 B divided by 300M sh outstanding) share with a 30% control premium.

Financial Snapshot from Page 10:

CORZ: Enterprise Value $6.3B, LTM Revenue $348M (80% self-mining, pivoting to HPC), Adjusted EBITDA $39M, Contracted Power 590 MW.

CoreWeave: EV $81.5B, Revenue $3.5B, EBITDA $2.2B, Power 2.2 GW.

Merger Math: 0% premium at current values, negative spread, and a deal that locks in discounts while ignoring CORZ’s growth (e.g., terminal value for contracts undervalued).

The Bigger Picture: Lessons from the AI Infra Bubble

This flop isn’t just about one deal; it’s a cautionary tale for the “Bitcoin-to-AI” pivot we’ve been tracking. Miners like CORZ are sitting on goldmines of infrastructure, but hyperscaler desperation doesn’t mean you give it away. Shareholders saw through the hype, betting on standalone value amid soaring AI capex ($370B projected by 2038). CoreWeave walks away unscathed, deal-hunting elsewhere (as their “spree” continues), while CORZ trades up post-rejection,proof the market agrees.

Where do Two Seas see future potential price of CORZ given its power footprint- $38.10 to $64, a whopping 2x to #x return, Is that likely and when can we see this valation reset.

MINER-MATH

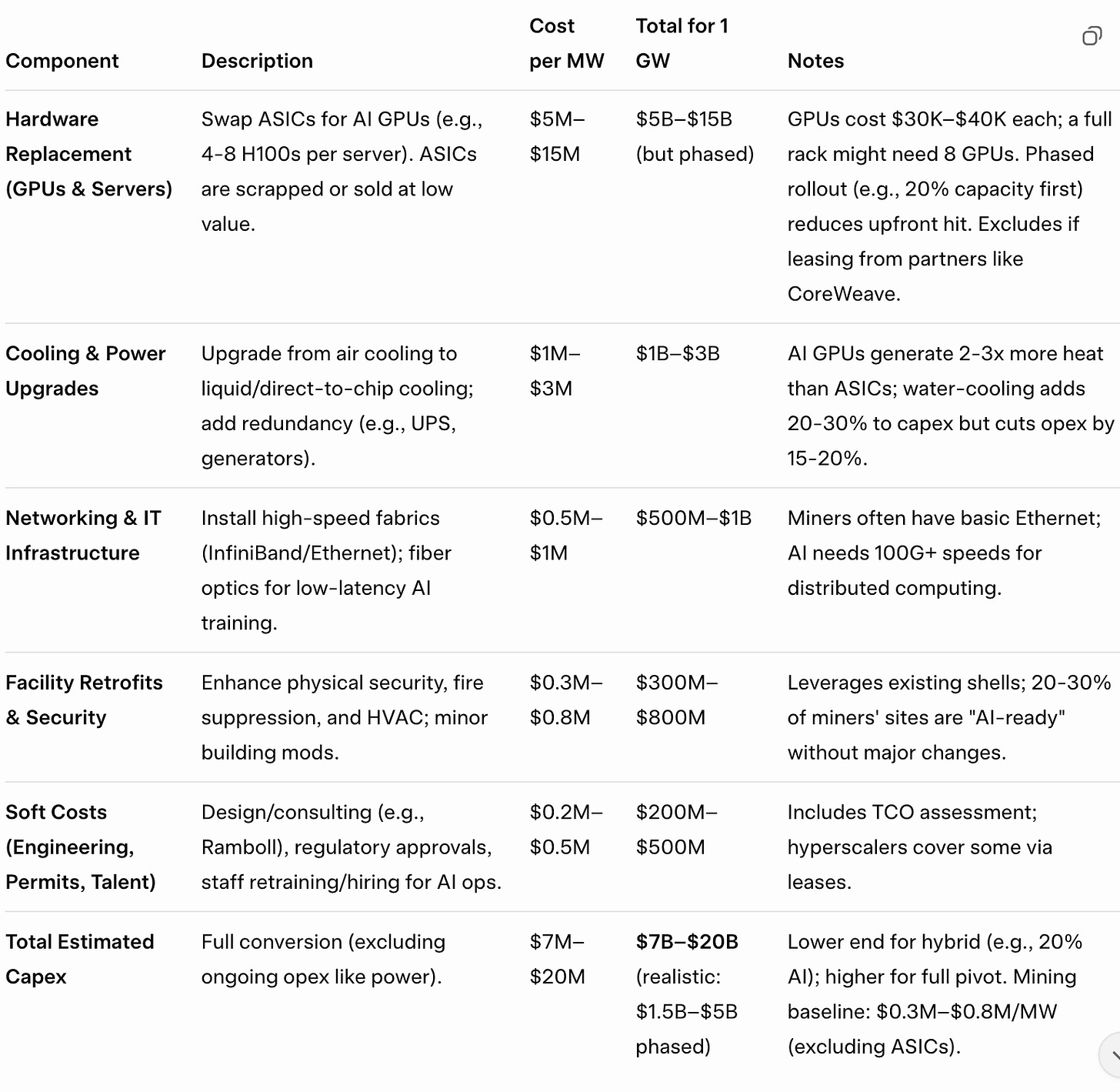

Lets analyze math behind -Key Cost Components for a 1GW Conversion

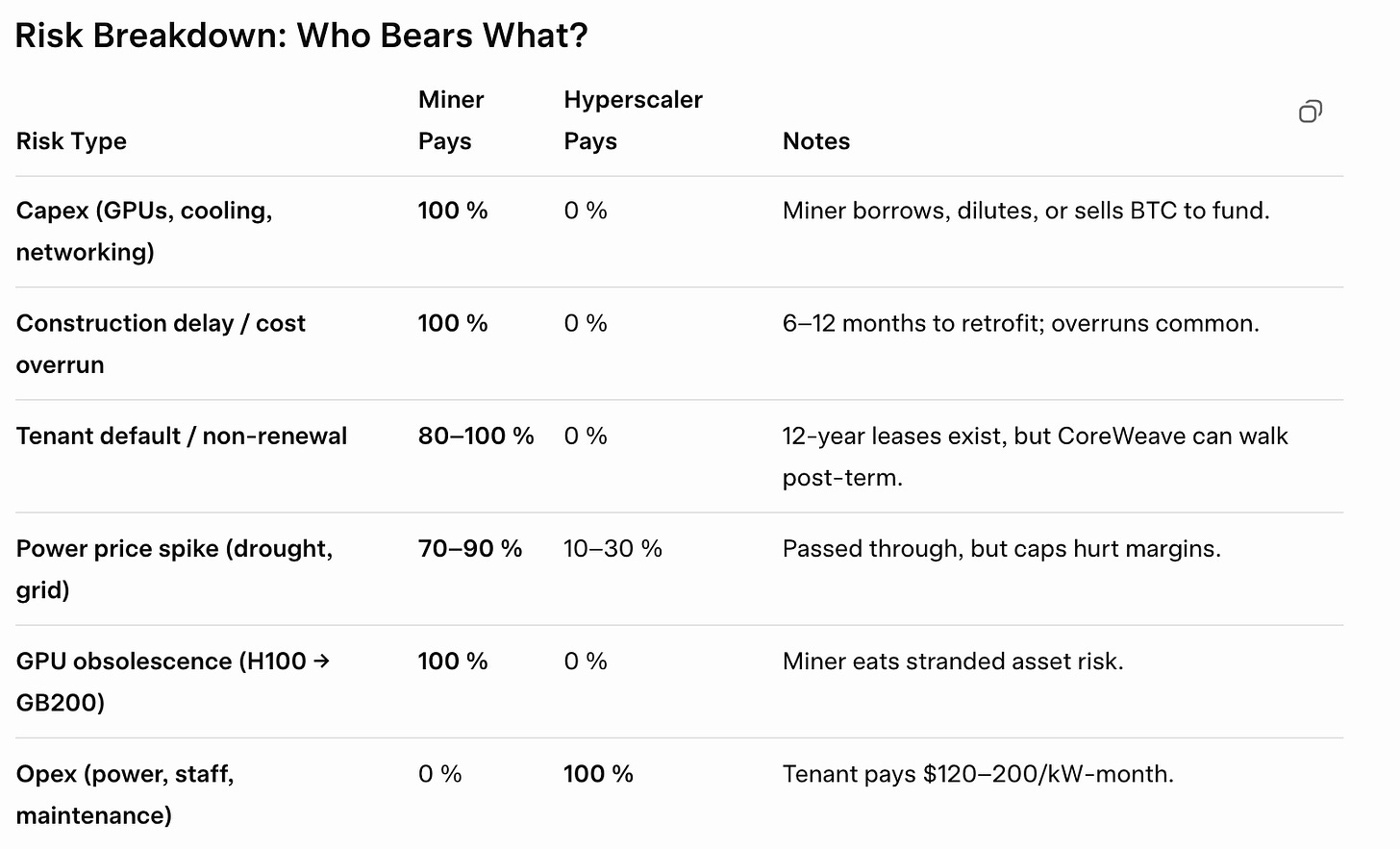

If the miner pays for capex now and gets operating income later then the miner is taking a lot of risk?

CORZ Stock Post-Merger Rejection: Why Only a 17% Bump, Not the Moonshot Two Seas Promised?

Economic Rationale: Is It Worth It?

My trade on CORZ

CORZ Stock Post-Merger Rejection: Why Only a 17% Bump, Not the Moonshot Two Seas Promised?

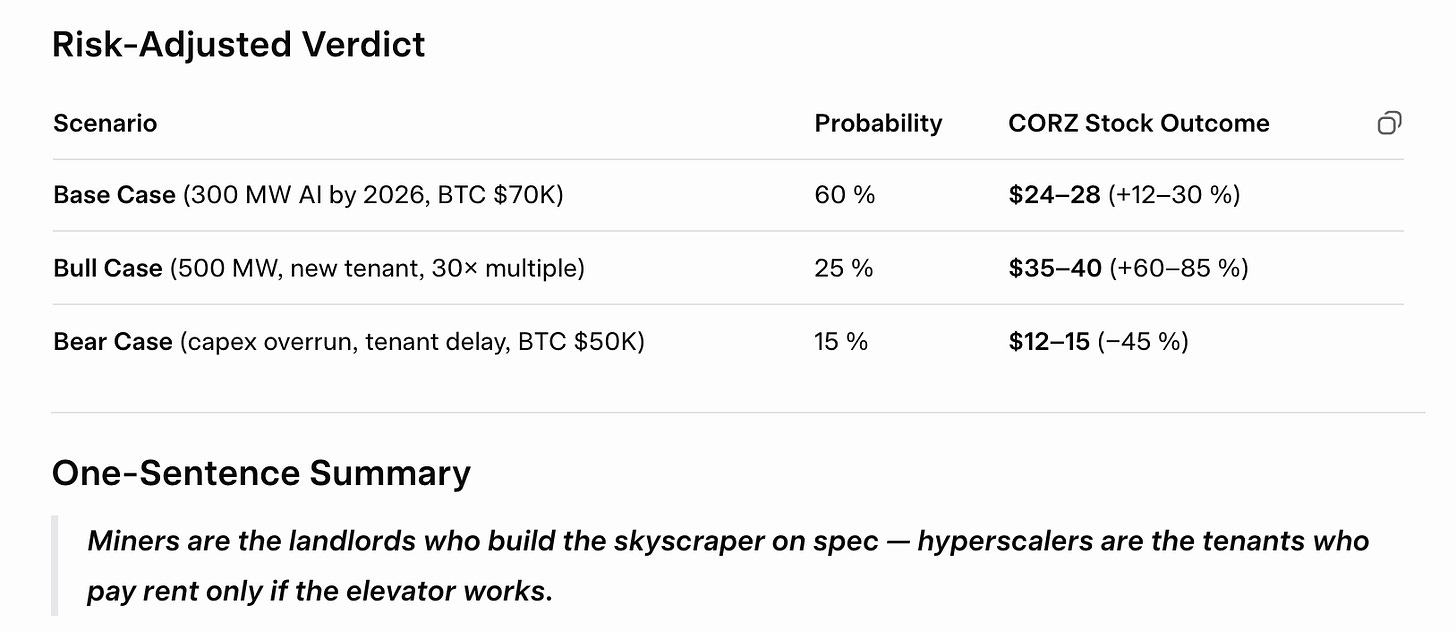

The 17% pop post-rejection (from ~$17.7 implied deal value to ~$20.80) reflects relief that CORZ avoided a “take-under” tethered to CoreWeave’s volatile stock (which dropped 15-45% post-announcement). Analysts like Bernstein upgraded their target from $17 to $24 on November 3, citing standalone upside, and the consensus average is now $27.65 (high $40). But that’s still well below Two Seas’ $38-$64, which assumes flawless execution: 1 GW+ fully leased at $180-200/kW-month, 68% margins, and a 25-30x EV/EBITDA multiple (vs. current 22x ‘26 estimates).

Why stalled here? The market’s baking in potential but discounting for risks. CORZ’s 52-week high is $23.63, so $20.80 is near peaks any further rally needs catalysts like new hyperscaler deals (e.g., expanding the existing 200 MW CoreWeave contract to 500 MW).

2. Execution Risks Loom Large: Capex, Debt, and the Pivot’s “Prove It” Phase

Two Seas’ deck painted CORZ as undervalued infrastructure gold (e.g., 590 MW contracted power scaling to 1.3 GW), but the market remembers the $1.2B+ capex burn for AI retrofits (GPUs, cooling) and $14B enterprise value weighed by debt. Q3 2025 results (released October 24, pre-rejection) showed a $147M net loss and revenue miss ($81M vs. $107M est), highlighting capex drag while AI revenue ramps slowly.

Stall factor: No new tenant announcements since rejection. CoreWeave’s “deal spree” continues elsewhere (e.g., poaching from Riot or Iris), signaling they’re not desperate to upsize with CORZ.

3. Cipher Comparison: Why CIFR’s Multiples Don’t Translate (Yet)

Cipher (CIFR) trades at a premium: ~13x EV/EBITDA (implied from $8.01B EV and growth est.), with a 303% YTD gain fueled by a $5.5B, 15-year AWS lease for 300 MW AI capacity (announced November 3, surging stock 19%). But Cipher doesn’t fully own its power, it’s leasing space/power via JVs and agreements (e.g., AWS deal where Cipher finances 95% but it’s a lease structure, not outright ownership). They own facilities like Bear Lake but rely on third-party power contracts, similar to CORZ’s model.

Why no CORZ catch-up? CIFR’s rally was catalyst-driven (AWS deal locks $5.5B revenue, de-risking the pivot). CORZ lacks that “gotcha” moment post-rejection,its CoreWeave tie (80% of AI pipeline) is sticky but not expanding publicly yet. Plus, CIFR’s lower debt and faster HPC shift (1 GW pipeline) make it “cleaner”; CORZ’s bankruptcy scars and higher leverage (debt-to-equity ~2.9x adj.) cap enthusiasm. Market sees CIFR as overvalued (intrinsic $12.84 vs. $22.52), but its news flow justifies the premium, CORZ needs the same to close the gap.

Lets analyze math behind -Key Cost Components for a 1GW Conversion

Costs vary by site specifics (e.g., existing cooling, location), but here’s a per-MW breakdown scaled to 1 GW (1,000 MW). Estimates draw from recent industry analyses and deals.

Phasing Reduces Risk: Start with 10-20% capacity (e.g., $150M–$500M initial outlay) to test AI revenue before scaling.

Opex Impact: Power remains ~$50-75/MWh (passed to tenants); AI boosts utilization to 90%+ vs. mining’s volatility. Total ownership cost (TCO) drops 20-30% long-term due to stable contracts.

Financing: Miners are raising debt/equity (e.g., $1B+ via bonds); AI leases provide predictable cash flow for repayment.

Real-World Examples

Several miners have executed partial conversions, providing cost benchmarks:

Core Scientific (200 MW AI Deal, 2024): Signed a 12-year, $3.5B hosting deal with CoreWeave for AI/HPC. Involved GPU deployment and cooling upgrades; estimated retrofit cost ~$200M–$500M (10-25% of total deal value). Scaled a 100 MW site in 6 months. Revenue: $120–$180/kW-month, yielding $174/MWh vs. mining’s $129/MWh margin.

HIVE Digital Technologies (~25 MW GPU Repurpose, 2023-2025): Invested $30M in NVIDIA GPUs for AI cloud services across Sweden, Iceland, and Canada sites. Hybrid model: Shifts between mining and AI. Result: 226% YoY revenue growth to $187M in Q2 2025; AI now >50% of earnings.

Iris Energy (IREN) & Cipher Mining: IREN’s 2.7 GW pipeline includes AI pilots; Cipher’s Black Pearl (hydro-powered) added HPC flexibility for ~$50M/MW upgrade. Combined, these show 30% cost edge over traditional clouds due to cheap power.

CleanSpark (100 MW Wyoming Site, 2025): Beat Microsoft for a deal by deploying in 6 months (vs. 3-6 years for new builds). Capex: ~$100M–$300M; leverages existing substation.

Industry-wide, U.S. miners control ~6 GW with plans to double by 2027; 20% could convert profitably, per VanEck, generating $13.9B annual AI revenue.

If the miner pays for capex now and gets operating income later then the miner is taking a lot of risk

The miner is taking most of the risk in the Bitcoin-to-AI pivot. They front $1.5–5 B in capex per GW, with no guaranteed tenant until the racks are live and humming. Hyperscalers pay opex only, and only after the facility is AI-ready.

Bottom line: Miner = venture capital. Hyperscaler = SaaS customer.

Risks Capping Upside

High Capex Drag: $1.5-5B for 1GW AI shift (as we discussed) could balloon debt ($14B+ total post-deal fallout), squeezing margins to 40-50%. Q3 revenue dipped 16% YoY to $79.5M on integration costs.

Execution Hiccups: Power costs >3¢/kWh or delayed GPU shipments = 20% downside to $17.

Market Sentiment: X chatter hyped the merger rejection, but if no new deals by Q2 ‘26, fades to $18.

My Take: 20-40% realistic upside in 12 months if AI hosting hits $150/kW-month. Bull: $35+ on another big tenant. Trade: Buy dips below $20; target $28 with $18 stop. (DCF shows fair value $24-28 at 18x ‘26 EV/EBITDA.)

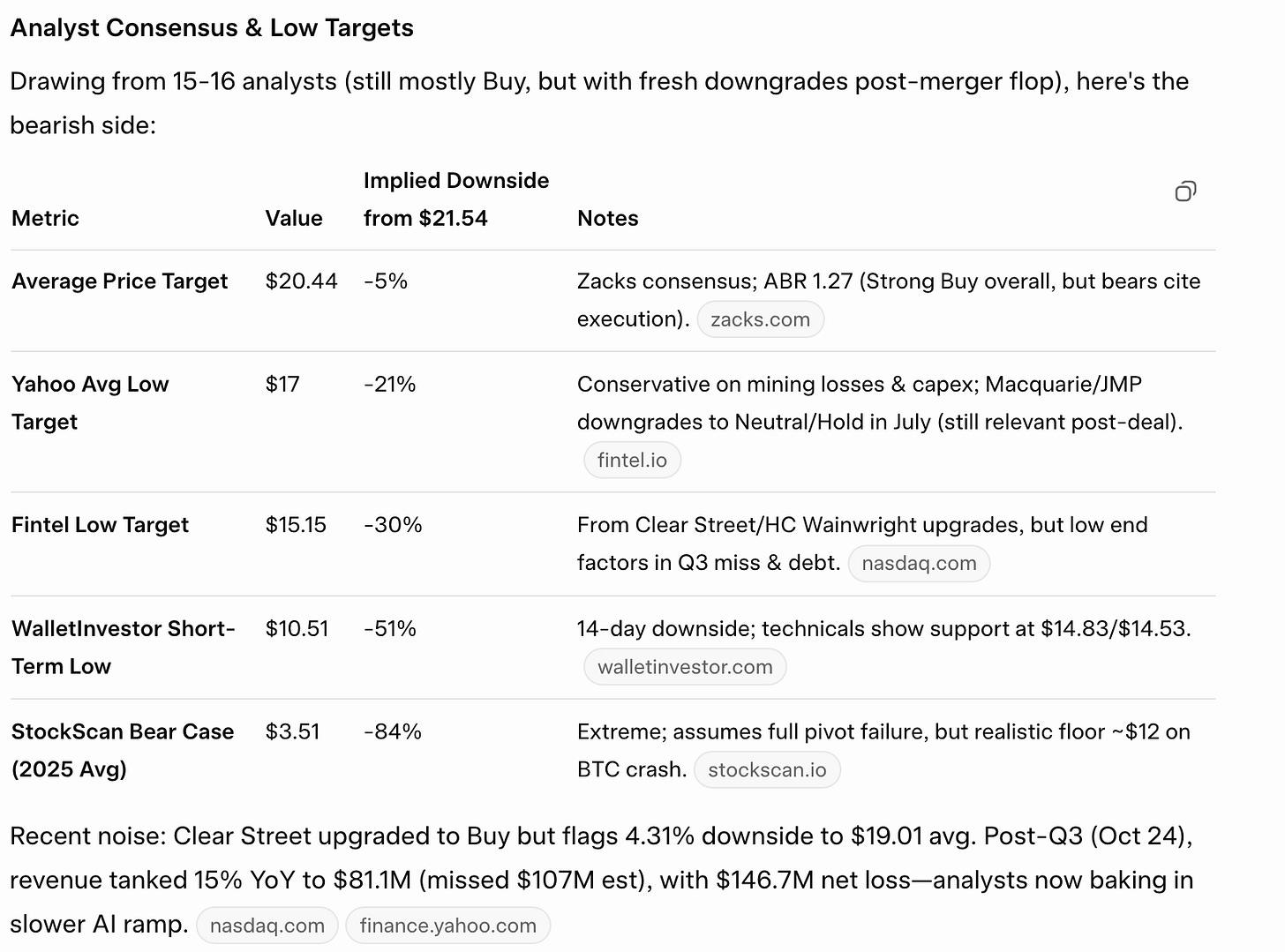

Core Scientific (CORZ) Stock Downside Potential: Quick Breakdown (as of Oct 31, 2025)

Current Price: ~$21.54 (intraday), flat after yesterday’s 6% pop on the rejected CoreWeave merger. Shareholders nixed the $9B all-stock deal, citing undervaluation and no downside protection, now CORZ stays independent, but execution risks loom large.

Short Answer: Analysts flag 10-30% downside from here, with low targets implying ~$15/share (-30%). Bear case drops to $12 (-44%) if AI pivot falters amid high capex and BTC weakness. Conversion costs ($1.5-5B for 1GW) is biggest drag, potentially spiking debt and eroding margins.

No-BS verdict on Core Scientific (CORZ) as of 31 Oct 2025:

Short answer:

Three things that flip CORZ to cheap

CoreWeave upsizes to 500 MW by Q2 2026

NVIDIA GB200 racks ship on time (Q4 2025)

Power cost stays ≤3 ¢/kWh (Texas drought risk)

Yes – CORZ is trading ~30 % above fair value on AI hype alone.

Buy only if you believe CoreWeave will sign another 500 MW at $200/kW-month within 12 months.Overvalued by 30 % today.

**Wait for the Q4 2025 earnings pullback (Feb 2026) to buy the AI miner dip at $15–$17

My trade

Sell ⅓ position at $24 → lock 100 % gain from $12 IPO

Hold ⅓ with $28 stop

Add below $16 if Q4 earnings miss (very likely)

Bottom Line: It’s a Waiting Game, Not a Bust

Two Seas’ $38-64 is aspirational, market assigns a 20-40% risk discount for capex overruns, tenant concentration, and BTC exposure. The stall reflects caution, not disbelief; a big deal (like Cipher’s AWS) could ignite it. If no catalysts by year-end, expect a dip to $16-18. Trade idea: Buy below $19, target $28 on news; short if BTC <$100K. This “AI miner” bubble has air, but CORZ’s power edge keeps it afloat, just not soaring yet.

The power infrastructure point is crucial for CIFR's positioning in this pivot. Cipher Mining has been securing longterm power contracts which gives them a real advantage over miners scrambling for capacity now. Their Texas facilities with access to cheap energy could be the differentiator when margins get tight. The question is wether they can scale fast enough to compete with hyperscaler demand.